It seems like a winning formula: When workers are paid adequate wages, they’re able to sustain their families, and even to thrive. And employers enjoy myriad benefits when they pay adequate wages: healthier workers, reduced turnover, higher productivity, stronger loyalty, and fewer disciplinary problems, to name a few.

It’s a win–win that is compelling some employers to make the choice to pay wages well above the federal minimum wage. In fact, the math has proven, time and again, that this results in a positive ROI.

While many employers are willing to examine their labor practices down through their supply chains in other countries, not as many are turning the spotlight on their domestic workforce. But there are many compelling reasons for employers to commit to robust wages for workers here at home.

What is a living wage?

The answer to this question is both stunningly simple and devilishly complex.

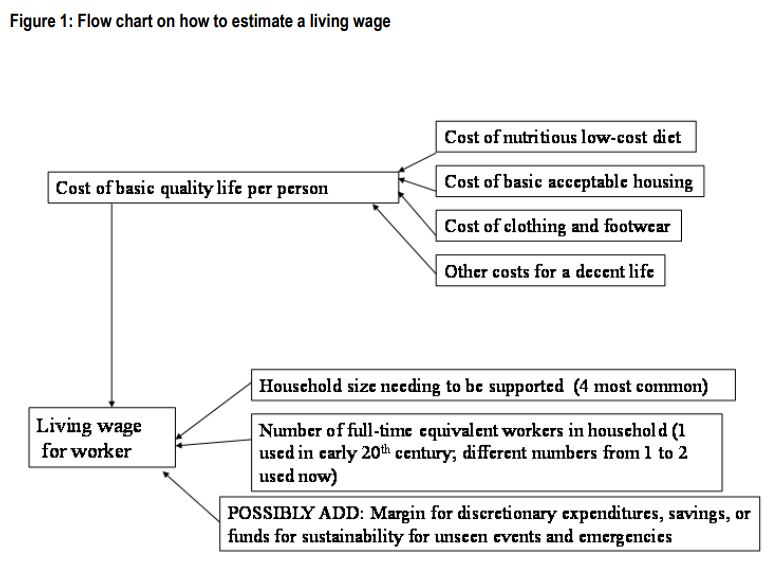

Simply put: A living wage provides enough to enable a worker to support a family with a basic, but decent, lifestyle.

However, in a country as complex as the US, the idea of “decency” leads to many qualifying questions. While people debate what should be included, most agree on a few basic elements:

- Nutritious food

- Acceptable housing (including utilities)

- Clothes

- Other: This may include transportation, healthcare, child care, household furnishings, recreation, communications, and personal care.

After determining and accounting for the main expenses, the calculation may adjust to accommodate family size, number of income earners, and the cost of living where the family resides.

My organization, Oxfam, defines a living wage as one which enables a family to meet its basic needs, with a small amount for discretionary spending.

We consider a living wage methodology to be credible when it:

- Involves participation of local people and organizations

- Includes housing and other costs differentiated for different parts of the country

- Is transparent, and provides documentation of the methodology

From Estimating a living wage: A methodological review:

Who determines the minimum wage now?

In the US, the federal minimum wage was established in 1938, and it continues to set a floor for the very least that a job may pay. However, there is no provision to adjust for regular increases in costs of living. And so it declines in value year after year, unless Congress takes action. It has now been eight years since the wage was raised to $7.25 an hour; since that bump (of less than a dollar), the cost of groceries has increased by more than 25 percent.

Today, $7.25 is a poverty wage by nearly every measure. At 40 hours a week for 52 weeks a year, a worker earns (before taxes) $290 a week and $15,080 annually. The poverty guideline for a family of two is $16,240. While proposals to raise the wage have ranged widely, many legislators and workers’ organizations today are pushing for $15.

As Congress refuses to consider raising the minimum, other actors are working to supersede the federal wage. These range from state and local efforts (such as Seattle’s move to raise its minimum wage to $15 and Massachusetts’ statewide increase to $11) to employers who choose to pay well over the minimum wage, even at entry level.

In Great Britain, the Living Wage Foundation has engaged over 100,000 employers in committing to its definition of a living wage. While the government minimum is 7.05/7.50 British pounds (under and over 25 years of age), the foundation puts a minimum living wage at 8.45 pounds (~US$11) across the UK, and US$12.68 in London.

It’s vital to note that keeping the wage floor below poverty level has a disproportionate effect on the most vulnerable workers and their families. People of color and women earn consistently (sometimes significantly) lower wages than men and whites. Currently, nearly half of women workers and 60 percent of Hispanic workers earn under $15 an hour. Women of color take a particular hit; average wages for Latinas are roughly half that for white men.

Why pay a living wage?

Employers across a variety of industries have decided that paying the lowest possible wages ends up being counter-productive. From giants such as Aetna and Tyson Foods to thousands of small businesses, employers understand that the labor force is more complicated than a simple commodity. In short, there’s a positive ROI for paying more than the legal minimum.

The Peterson Institute for International Economics conducted an extensive review of literature spanning over 30 years and many companies. It concluded that higher wages:

- motivate employees to work harder

- attract more capable workers

- lead to lower turnover (reducing need to hire and train new workers)

- improve performance

- reduce absenteeism and disciplinary problems

- reduce need to monitor employees

The Peterson Institute also determined that higher wages may lead to better employee health, greater productivity, greater job satisfaction, and enhanced reputation with customers.

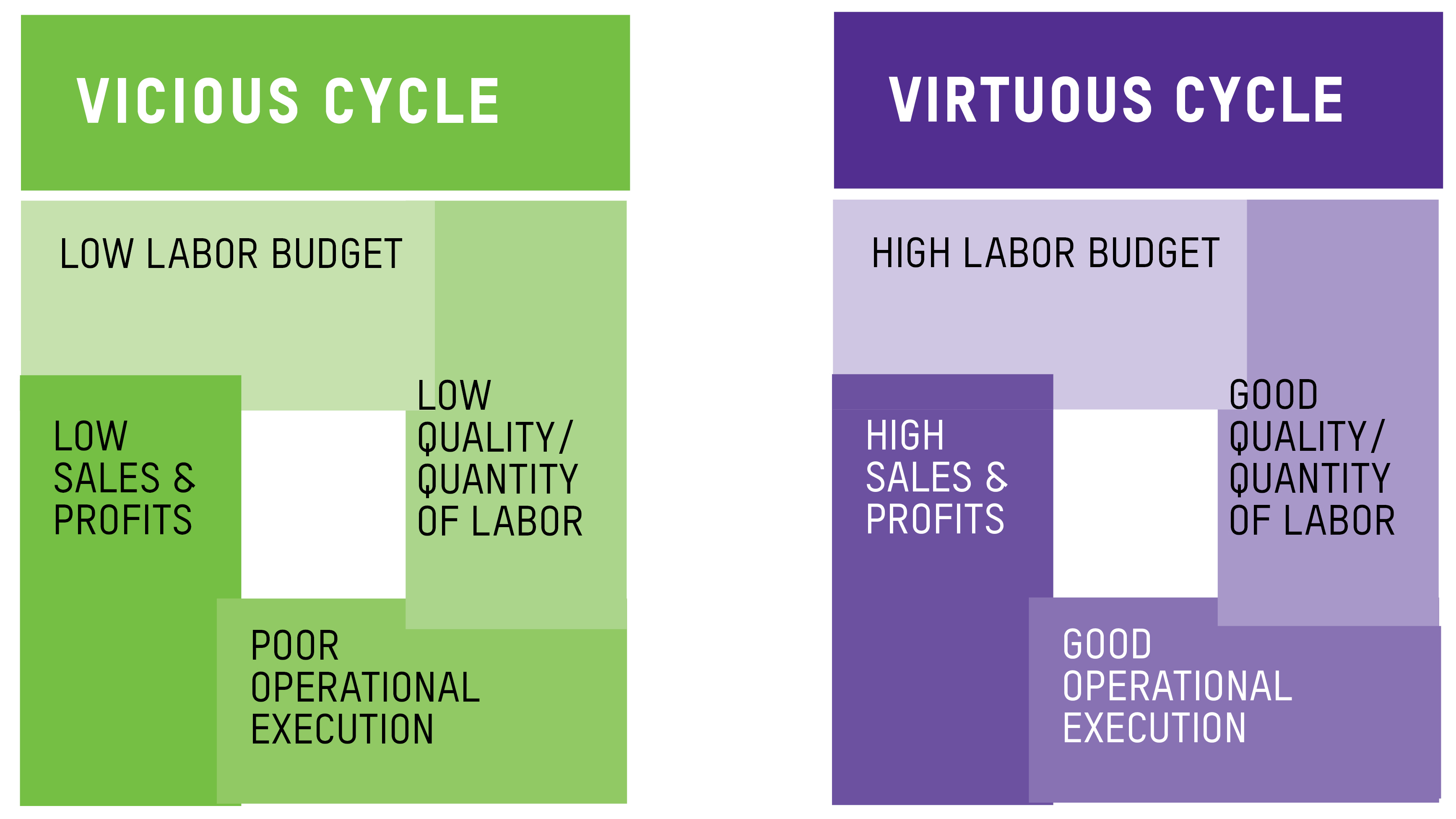

In her groundbreaking work, Zeynep Ton describes the benefits a business can reap from a “good jobs” strategy. She characterizes “vicious” versus “virtuous” cycles in labor practices. In the vicious cycle, businesses respond to short-term pressures to pay low wages with few benefits. The result is that workers are disengaged, and the business suffers: absenteeism is common, turnover is high, mistakes are frequent, and the operation is eventually plagued with problems.

In the virtuous cycle, workers are regarded as an integral part of the business. Businesses that pay higher wages attract more loyal and productive workers, experience less absenteeism and turnover, and see fewer mistakes and accidents.

In addition, paying higher wages brings rewards to the economy as a whole: It enables workers to buy more consumer goods, which fuels demand and provides a stimulus to the broader economy; and it fuels local and national economic opportunities, leading to greater job creation.

In addition, paying higher wages brings rewards to the economy as a whole: It enables workers to buy more consumer goods, which fuels demand and provides a stimulus to the broader economy; and it fuels local and national economic opportunities, leading to greater job creation.

How to Implement a Living Wage

1. Look inward

The first step is to assess the reality of the situation in your organization.

- Benchmark your current wages against the living wage in states and localities where you operate. Refer to living wage calculators to get a sense of reasonable wages: The MIT Living Wage Calculator and the EPI Family Budget Calculator are easy to use.

- Determine if you are now paying a living wage to your employees and contracted workers.

- Be sure to assess conditions for contingent workers. While many employers take advantage of the convenience and cost-effectiveness of using firms, these contractors may leave workers with little security, low pay, and few benefits. Be realistic about how many people you employ this way, and include them in the calculation for living wages.

- Calculate the gap between CEO pay and average pay of employees, and between CEO pay and the minimum wage of workers in your key supply chains. Match this gap against the company’s values.

- Consult employees, and, if appropriate, unions. Moving toward a living wage offers opportunities for employees to engage, collaborate, and improve the organization.

- Engage your board in working toward a solution.

- Develop a plan with short- and long-term elements.

- Review your policy, and commit to transparency. Even if you already pay living wages, publish a statement acknowledging concerns about low wages, and expressing your commitment.

2. Look at sourcing strategy.

Map your supply chain, starting with key suppliers who may be high-risk/high-leverage in terms of wages.

- Work to understand the perspectives of your suppliers, especially their stress points.

- Take steps to get real data on total compensation from your suppliers, including benefits, overtime policy, and so on.

- When suppliers make progress, grant them preferential treatment and long-term contracts.

3. Look outward

You don’t have to do this alone! Partner with existing networks and coalitions.

- On the federal level, several organizations are working to engage employers who endorse the importance of raising the minimum wage, and encouraging other employers to pay living wages. Check out Business for a Fair Minimum Wage, American Sustainable Business Council, Main Street Alliance, and High Wage America.

- On the local level, many states and municipalities have chosen to raise the minimum wage. For more information, refer to the National Employment Law Project (NELP).

As you consider making changes to wage levels, make sure that any lobbying efforts align with your policy commitments. For example, recognize the importance of worker voice and empowerment, and take care not to endorse legislation that limits rights to organize or form a union (e.g., “right to work” laws). If you’re located in a city that has approved a higher minimum wage, make sure you are not lobbying the state to take steps to preempt that raise. And don’t participate in trade or professional associations that lobby on measures to remove worker protections.

See Living Wages as an Opportunity

Committing to a living wage for your workforce is not just a matter of raising ethical standards — it makes strong business sense. As many employers, both large and small, are discovering, the benefits of ensuring that workers are prosperous, healthy, and respected are many — and they have ripple effects into the community. A strong workforce is the bedrock of a thriving economy, and society.