CircleUp co-founders Rory Eakin and Ryan Caldbeck didn’t set out to tackle the funding gap that plagues female entrepreneurs (in 2016, only 2 percent of venture funding went to women). They just wanted to make it easier for any promising entrepreneur to raise money from accredited investors. “We saw that there were hundreds of thousands of fast-growing businesses across the US that faced a capital need and didn’t have a home in the capital markets,” Eakin says. So they started an investment marketplace to connect people with money to people with great ideas. Since its conception in 2012, CircleUp has helped more than 255 companies raise more than $390 million dollars in funding from its network of over 20,000 accredited investors.

CircleUp co-founders Ryan Caldbeck (right) and Rory Eakin

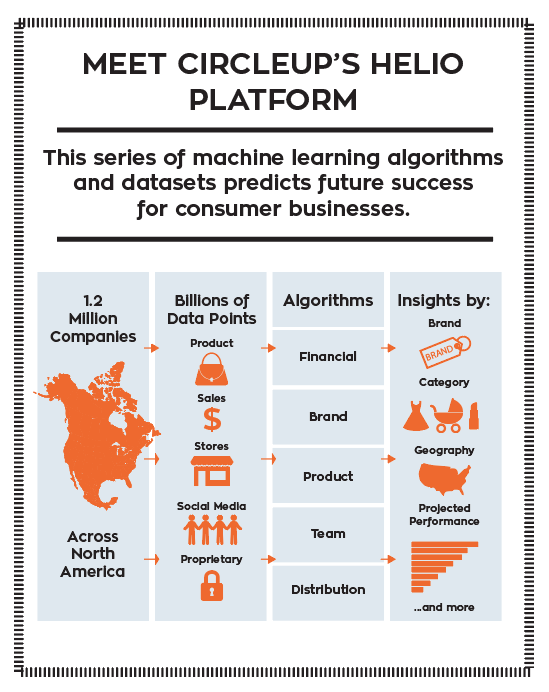

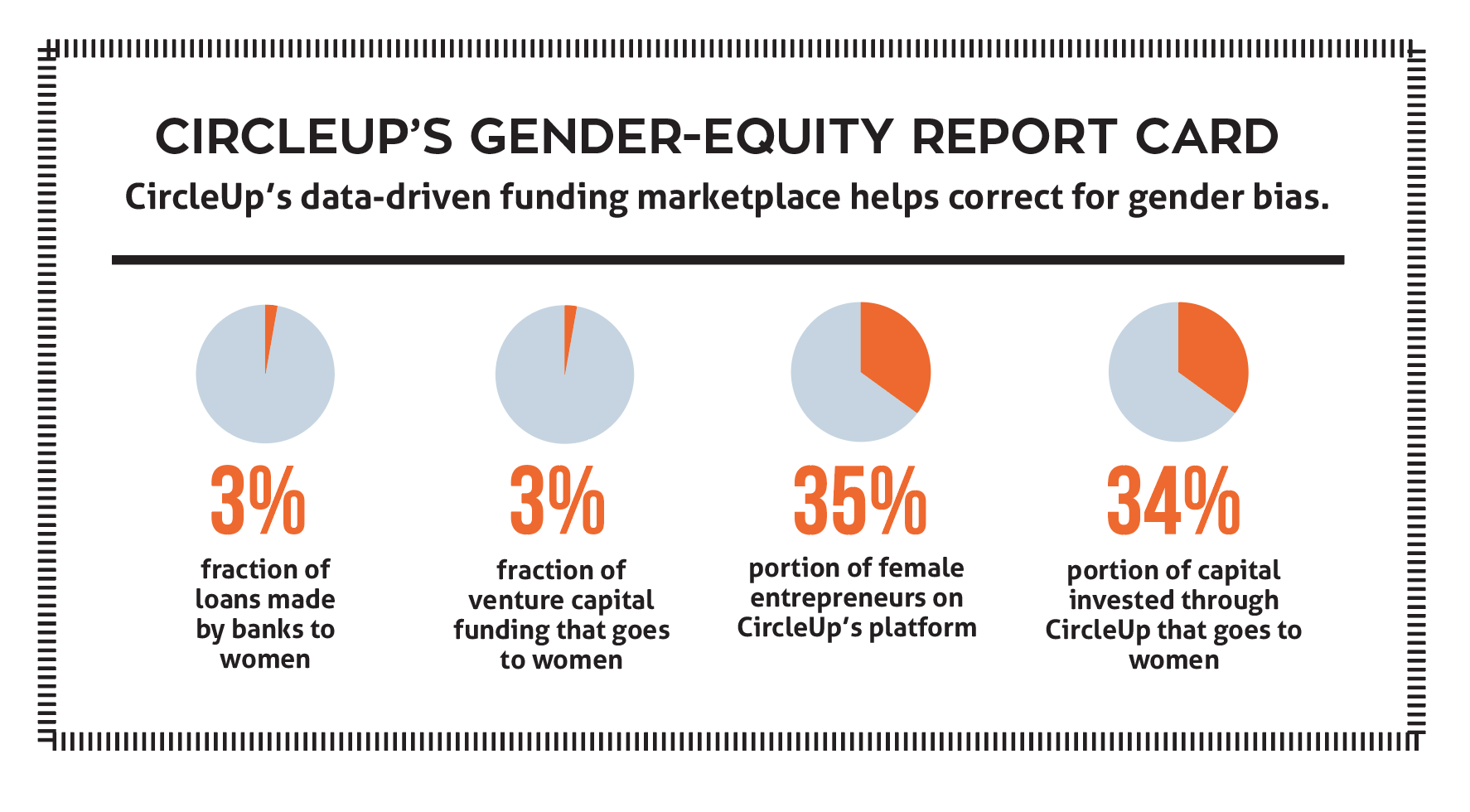

CircleUp’s platform uses a cluster of machine learning programs and algorithms called Helio to predict the financial performance of a company based on the strength of its brand, product, distribution, and management team in order to quickly determine whether that business is a fit for the platform. By contrast, traditional investing relies on an investor making a series of subjective judgments while analyzing data from the early days of other successful companies and investing in businesses that show similar traits, trends, or data points. The problem with this “pattern recognition” strategy is that human brains are great at finding meaningful patterns even where they might not exist — like in the fact that many successful founders are straight, white, male, and based in the Bay Area. By assessing businesses in a more democratic, data-driven way, CircleUp is reducing the likelihood of unconscious bias factoring into investment decisions and evening the playing field for businesses led by people from traditionally underfunded groups, especially women.

We talked with co-founder and COO Rory Eakin to learn more about how the platform works and his advice to entrepreneurs.

CircleUp At A Glance

• Location: San Francisco, CA

• Founded: 2012

• Team Members: 55

• Impact: 250+ consumer and retail companies connected to more than $390 million

• Structure: Private for-profit

• Mission: “To help entrepreneurs thrive by giving them the capital and resources they need.”

The Interview

How would an entrepreneur know if their business might be a good fit for raising capital with CircleUp?

Rory Eakin: It varies from company to company, but we are typically not the first capital for a business. A typical company appropriate for and successful on our platform has at least $1 million in revenue, is growing about 100 percent per year, and produces a packaged consumer product — a product that sits on the shelf.

Within that, there are other factors like gross margin, the financial health of the business, how quickly they’re achieving net sales growth, where they’re distributed, the type and nature of their products, and the engagement of the customers with those products. Ultimately, to make sure we attract the highest-quality investors, we need to have a high quality bar for our platform.

Is this a platform that’s especially good for conscious businesses — those that think about all stakeholders and have a purpose beyond profit?

RE: One of the things I’m most proud of is that we’ve been the number one source of capital for B Corps in the country. Companies that are integrating social, environmental, or labor standards into their charter or mission have a much higher percentage of the capital than just the B Corps themselves, and we have historically been a conduit for that type of investing.

What about the entrepreneurs who don’t fit the screen? Do you have any offerings for them?

RE: Our mission is to help entrepreneurs thrive, and we want to find ways to help all the entrepreneurs we can. Today we do that through our community forum, an open set of resources that help all entrepreneurs, whether we can work with them to raise capital or not. There’s information there about growing your business and scaling your team, and a common set of resources for all entrepreneurs, whether in the consumer space or beyond.

What trends do you see for your industry?

RE: The move towards the digitalization of industries is a powerful one, and it’s going to continue. What CircleUp is ultimately doing is taking a process that was analog and moving it to digital. It was individual meetings and emails and spreadsheets and face-to-face investors all flying around the country. It’s now becoming part of a digital environment, allowing us to do data analysis and enabling an entrepreneur in Boise to seamlessly connect with a family office in North Carolina. I’m optimistic that the use of technology to make it more efficient on both sides is something that’s only going to continue.

Do you ever get pushback from people who want the personal connection?

RE: I don’t mean to imply it’s not personal. CircleUp is simply starting the process. It’s making that spark. Eventually it’s still highly personal. When we engage with the CEO to come on the platform, it’s typically face-to-face or over email. It’s not just computers making that decision.

What I’m speaking about is the ability to leverage technology to create a better, more objective end-to-end process. It doesn’t displace the personal side of the investment, but it enables that connectivity of investors to entrepreneurs in disparate . Data doesn’t replace the personal side, it supplements it and makes it more efficient.

What’s giving you hope right now?

RE: If you look at long-term trends — global development indicators like entrepreneurship, small-business growth, and opportunities for different populations to raise capital — they are demonstrably better in virtually every measure, making things possible that weren’t ten years ago. Business models for good are also becoming more robust and more acceptable than they were five, 10, or 20 years ago. There are opportunities for companies to differentiate themselves on values, how they produce goods, how they market, and what they stand for; and reaching an audience of scale is much more possible than ever before. We’re coming to a point now where the informed consumer choice and increased selection will lead to meaningful shifts in market sharing, commercial power, and the way consumers and investors support new approaches to capitalism and to economic growth.